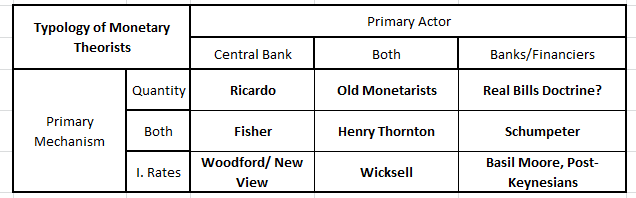

Carrying on from where I stopped last time on the monetary typology

5. Henry Thornton : I sometimes like to think that macroeconomics - or at least modern monetary economics - began with Henry Thornton. During the Bullionist controversy, he wrote his magnum opus at the start of the 19th century. The text, revived in the economic literature through the efforts of Jacob Viner in the 1930s, reads more modern than a majority of contemporary monetary discussions. Thornton's work is possibly the first successful marriage of the currency and the banking principles (see pg 296 onwards here for more reference on the difference between the two). Schumpeter considered it the best theoretical monetary performance of the 1790-1870 era in his HEA (pp 657-658). Thornton anticipated Wicksell's cumulative process of the expansion or contraction of the economy, in what was a bid to explain the observed regularity between issue of central bank liabilities and the nominal economy, which is simply assumed by the quantity theory of money (QTM). As Schumpeter notes (HEA, pp 676-677, 702-703), only Ricardo and a few of his closest associates ever believed in the "strict" (we would today call it "naive") form of quantity theory. Thornton, though he was on Ricardo's side in the Bullionist controversy, sought to explain it using processes and phenomena that he saw in the 'real world', rather than posit it as a matter of logic, as Ricardo did. In all, Thornton represents the centre in the theory of monetary policy - comfortable with currency and credit, with quantities and rates, with a belief in the power of central banks, though acting through private financial agents.

6. Schumpeter : I label this cell with Josef Schumpeter's name borrowing from Ashwin, who describes endogenous money creation through banks' extension of credit as an idea that is first/best explained in Ch 3 of his book Theory of Economic Development. I haven't read it, so I will defer to Ashwin's judgement, with the caveat that Schumpeter was an unbelievably wide scholar of the history of economic thought, and it is my prior that someone so widely read is unlikely to hold 'polar' positions. So, Schumpeter himself might have been a 'Schumpeter-ian centrist', somewhere between the Thornton & Schumpeter cells in my typology. However, we are more concerned with what the cell signifies rather than the views of Schumpeter himself - so what makes for a Schumpeterian theory of monetary actors and mechanisms?

In short, this is a view that infuses the financial/banking system with a lot of autonomy, through both prices (interest rates) and quantities and thus renders the central bank a relatively smaller player in the purely monetary scheme of things. The endogeneity of money (supply) is a common heterodox position and a large number of theorists with widely divergent policy prescriptions - Austrians, Real Bills theorists, Post Keynesians, etc. - hold views on it which seem remarkably similar. I submit that what would be specifically *Schumpeterian* is the view that the financial system leads/should lead credit and money creation rather than responding passively to consumer or investor (real economy investors, i.e. businesses) demand. The argument is definitely a claim about how the world works but is perhaps also normative, enshrined in Schumpeter's twin views - as Ashwin describes it - of money creation through elastic credit as the differentia specifica of capitalism, and of the banker as the capitalist par excellence. This is in some contrast to the real bills view (banks/central banks *should* extend money only against safe, short term collateral) as well as the canonical Post Keynesian 'horizontalist' view that even privately created endogenous money is merely 'accommodative' i.e. responding passively to exogenous money demand. However, the monetary views of some notable 20th century empirical theorists - particularly John Gurley and Edmund Shaw - are of a Schumpeterian nature and the approach also resonates with Post Keynesians of a more 'Structuralist' persuasion - witness Thomas Palley or Bob Pallin.

7. Woodford/New View : In 2003, Mike Woodford wrote what continues to be the benchmark monetary theory text in graduate macroeconomics. Woodford visualized a "cashless", or more precisely a currency-less economy where monetary policy is focused on price stability and is conducted using just the short rate, with the rest of the yield curve taking care of itself through financial equilibrium. While this has been seen as a modern take on a Wicksellian 'pure credit' economy, Woodford's attempt should also be seen as the proper development of the 'New View' of monetary economics that began with Jim Tobin's explorations of monetary economics in a world of modern financial internediaries and assets in the early 1960s. As Perry Mehrling notes, Woodford's work should be seen not simply as a New Keynesian reponse to the rational expectations revolution, but also as an initial attempt by modern macroeconomics to rise to the challenge of modern finance.

I identify the critical element of this view as the attempt to infuse the monetary sovereign with full policy control through a monetary instrument, even in a world of entirely interest-bearing money. Money is the numeraire, and the main monetary channel is expectations of future monetary action. In developed economies with elaborate forward-looking financial markets, in a world of treasury ETFs, money market mutual funds, zero-cost sweeps between demand deposits and time deposits etc. - the Woodford-ian schema seems entirely reasonable as the default prior to begin working with.

Rest to follow in parts III and IV.

5. Henry Thornton : I sometimes like to think that macroeconomics - or at least modern monetary economics - began with Henry Thornton. During the Bullionist controversy, he wrote his magnum opus at the start of the 19th century. The text, revived in the economic literature through the efforts of Jacob Viner in the 1930s, reads more modern than a majority of contemporary monetary discussions. Thornton's work is possibly the first successful marriage of the currency and the banking principles (see pg 296 onwards here for more reference on the difference between the two). Schumpeter considered it the best theoretical monetary performance of the 1790-1870 era in his HEA (pp 657-658). Thornton anticipated Wicksell's cumulative process of the expansion or contraction of the economy, in what was a bid to explain the observed regularity between issue of central bank liabilities and the nominal economy, which is simply assumed by the quantity theory of money (QTM). As Schumpeter notes (HEA, pp 676-677, 702-703), only Ricardo and a few of his closest associates ever believed in the "strict" (we would today call it "naive") form of quantity theory. Thornton, though he was on Ricardo's side in the Bullionist controversy, sought to explain it using processes and phenomena that he saw in the 'real world', rather than posit it as a matter of logic, as Ricardo did. In all, Thornton represents the centre in the theory of monetary policy - comfortable with currency and credit, with quantities and rates, with a belief in the power of central banks, though acting through private financial agents.

6. Schumpeter : I label this cell with Josef Schumpeter's name borrowing from Ashwin, who describes endogenous money creation through banks' extension of credit as an idea that is first/best explained in Ch 3 of his book Theory of Economic Development. I haven't read it, so I will defer to Ashwin's judgement, with the caveat that Schumpeter was an unbelievably wide scholar of the history of economic thought, and it is my prior that someone so widely read is unlikely to hold 'polar' positions. So, Schumpeter himself might have been a 'Schumpeter-ian centrist', somewhere between the Thornton & Schumpeter cells in my typology. However, we are more concerned with what the cell signifies rather than the views of Schumpeter himself - so what makes for a Schumpeterian theory of monetary actors and mechanisms?

In short, this is a view that infuses the financial/banking system with a lot of autonomy, through both prices (interest rates) and quantities and thus renders the central bank a relatively smaller player in the purely monetary scheme of things. The endogeneity of money (supply) is a common heterodox position and a large number of theorists with widely divergent policy prescriptions - Austrians, Real Bills theorists, Post Keynesians, etc. - hold views on it which seem remarkably similar. I submit that what would be specifically *Schumpeterian* is the view that the financial system leads/should lead credit and money creation rather than responding passively to consumer or investor (real economy investors, i.e. businesses) demand. The argument is definitely a claim about how the world works but is perhaps also normative, enshrined in Schumpeter's twin views - as Ashwin describes it - of money creation through elastic credit as the differentia specifica of capitalism, and of the banker as the capitalist par excellence. This is in some contrast to the real bills view (banks/central banks *should* extend money only against safe, short term collateral) as well as the canonical Post Keynesian 'horizontalist' view that even privately created endogenous money is merely 'accommodative' i.e. responding passively to exogenous money demand. However, the monetary views of some notable 20th century empirical theorists - particularly John Gurley and Edmund Shaw - are of a Schumpeterian nature and the approach also resonates with Post Keynesians of a more 'Structuralist' persuasion - witness Thomas Palley or Bob Pallin.

7. Woodford/New View : In 2003, Mike Woodford wrote what continues to be the benchmark monetary theory text in graduate macroeconomics. Woodford visualized a "cashless", or more precisely a currency-less economy where monetary policy is focused on price stability and is conducted using just the short rate, with the rest of the yield curve taking care of itself through financial equilibrium. While this has been seen as a modern take on a Wicksellian 'pure credit' economy, Woodford's attempt should also be seen as the proper development of the 'New View' of monetary economics that began with Jim Tobin's explorations of monetary economics in a world of modern financial internediaries and assets in the early 1960s. As Perry Mehrling notes, Woodford's work should be seen not simply as a New Keynesian reponse to the rational expectations revolution, but also as an initial attempt by modern macroeconomics to rise to the challenge of modern finance.

I identify the critical element of this view as the attempt to infuse the monetary sovereign with full policy control through a monetary instrument, even in a world of entirely interest-bearing money. Money is the numeraire, and the main monetary channel is expectations of future monetary action. In developed economies with elaborate forward-looking financial markets, in a world of treasury ETFs, money market mutual funds, zero-cost sweeps between demand deposits and time deposits etc. - the Woodford-ian schema seems entirely reasonable as the default prior to begin working with.

Rest to follow in parts III and IV.

5 comments:

excellent article u shared,thanks for sharing.

Silver Mcx Tips

nice one boardexamresults2018.in

Thanks for sharing such a valuable information.

Delhi Police Constable Recruitment 2018

Interview Tips For Teachers

I like your post.

Current Political News in India

Bollywood News in India

Latest Entertainment News in India

Current World Technology News in India

I like your post.

Today Tech News

Latest Technology in the World

Computer News

Post a Comment